Buying a house can be one of the most expensive things you do in your adult life, but there are ways to mitigate the costs overall. These include both saving up until you have a considerable sum to put toward your new home and making a hefty down payment. While you can make a down payment as low as five percent, 10 percent is the happy medium and 20 is considered to be the very best overall. If you’re in the market for a new house, here are a few reasons why you should consider making the bigger financial commitment upfront.

Leave a CommentTag: Personal finance

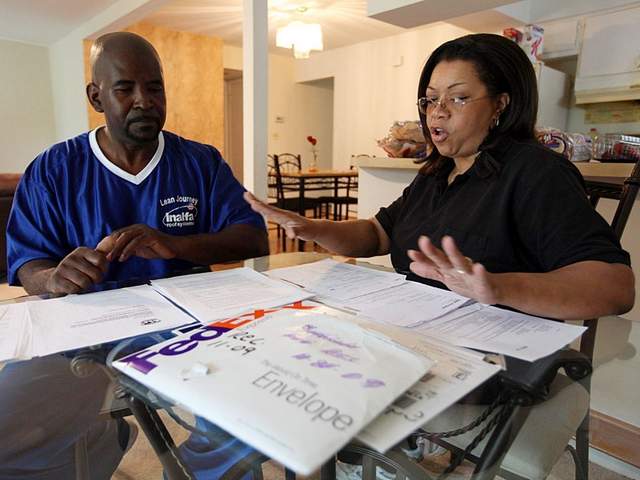

I have been thinking about purchasing a new rental property, but all of the things you have to worry about are too much for me to handle. While people make it seem like it is a breeze, I felt so confused when a friend tried to explain everything to me. The only thing I understand about the entire process is the importance of finding a lender and decent real estate broker.

Leave a CommentEven if you are keen to refinance your home, you may be hesitant to actually lock in an interest rate when rates continue to fluctuate and keep dropping. While it makes perfect and good sense that you would want to obtain the best possible deal, don’t let this good sense turn to bad sense by waiting forever to lock in. Some homeowners are hesitant to commit to an interest rate because they worry that if they’re locked in, a better rate will come along that they could have had if only they had waited. The fact of the matter is, locking the interest rate on a mortgage loan is, and always will be, a gamble. Sometimes you will be lucky and other times you won’t. That said, when you have a locked interest rate, you have the satisfaction of knowing that you are guaranteed this rate, regardless of whether the rates should go up at the time of your closing.

Leave a CommentIn the state of today’s economy, many people are desperate to find ways to make ends meet. From bill payments and home renovations or upgrades, to being able to pay for their children’s college educations, people are looking in every direction to make these things happen. For these reasons, some have even contemplated taking out a second mortgage on their home. If you are considering taking out a second mortgage on your home, it is important to understand the pros and cons involved with the act of taking out a second mortgage on your home.

Leave a CommentWith the current ecomony, more and more people are seeking home loan modification to try to relieve the building debt. While certainly a home loan modification can be a huge help to a struggling homeowner, there are also times when it is not a good fit. Knowing the difference between these situations is at the core of home loan modifications. Home loan modification is when the bank or lender adjusts the loan terms or balance so that the homeowner can more easily afford the payments. Sometimes they will adjust the interest rate, and sometimes they will extend the life of the loan to lower the payments. On rare occasions, they will forgive a portion of the principle balance as a home loan modification.

Leave a CommentAre you bearing many difficulties with your credit in so many ways that you require the most effective exit for you to come out of your debt problem? If you do, then it is right for you to visit Repair My Credit Now, as this internet site is offering you with the most leisurely direction to assist you in repairing your credit very easily. Credit repair is wholly what people require whilst they’re getting bad credit, for if they don’t fix their bad credit as soon as possible, it will have a bad affect on them in the time to come in contending with their fiscal problems.

Leave a Comment